Aspiring to live a happy retirement is a goal most of us share. That period in later life, free of the day job, ideally free of a mortgage, with time to finally pursue hobbies, travel, socialise and relax at home.

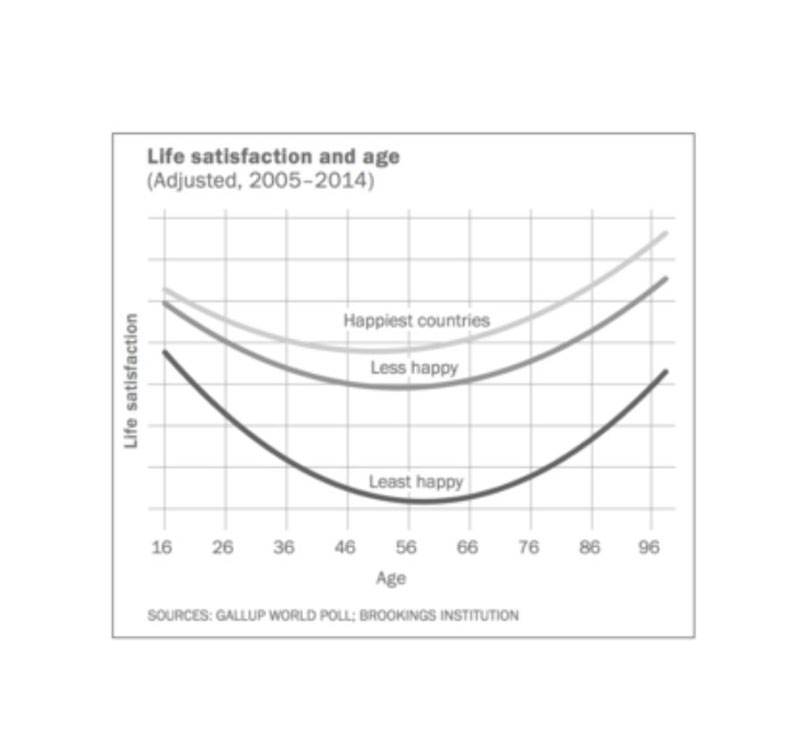

There is evidence to suggest that our levels of happiness fluctuate throughout our lives, at their very highest in childhood and again in later life, making a 'u shape', known as the u-curve of happiness.

What is the U-curve of happiness?

The ‘U-curve of happiness’ - before the inevitable eye roll - is not another wish-washy millennial term. Instead it has proven academic grounding in the 1990s during the resurfacing of happiness economics, when the relationship between work and happiness was studied.

From these studies, international surveys about life satisfaction were conducted. Evidence revealed that happiness through adulthood is in fact u-shaped and is even more visible in wealthier countries where life expectancy is longer and people live in better health.

“Life satisfaction falls in our 20s & 30s, then hits a trough in our late 40s before increasing until our 80s.”

- Jonathan Rauch, author, journalist and activist.

Life’s sweet spot

Psychologists believe that children and older people live in a “neurological and psychological sweet spot” as

they are the most able to enjoy life in the moment.

This is a reason life satisfaction begins to fall during our 20s and 30s, takes a further dive in our late 40s, before it starts to climb again and continues to do so as we reach later life.

While people may not necessarily class themselves as being unhappy, life satisfaction still dips for a number of reasons such as an increasing responsibility for others, and a growing unease about things that haven’t been achieved.

How to retire happy

The difference between living a happy life and a happy retirement is mostly financial. Eating well, getting enough sleep, exercising and having a strong network of friends and family available to call upon are some of the keys to happiness throughout our lives.

Retirement is a transition, something that happens over time and is a shared life goal amongst us all. The average age of retirement in the UK is 63, although many individuals show a drive to achieve this much sooner by adhering to a savings and investments plan to put away as much as possible to retire early.

But like most aspects of our lives, both in the home and at work, moderation and preparation are integral. A happy retirement will be the result of living well in the years prior and putting in the groundwork to be financially secure later.

Read our latest Guide To Downsizing or find out more about retirement living at Audley.